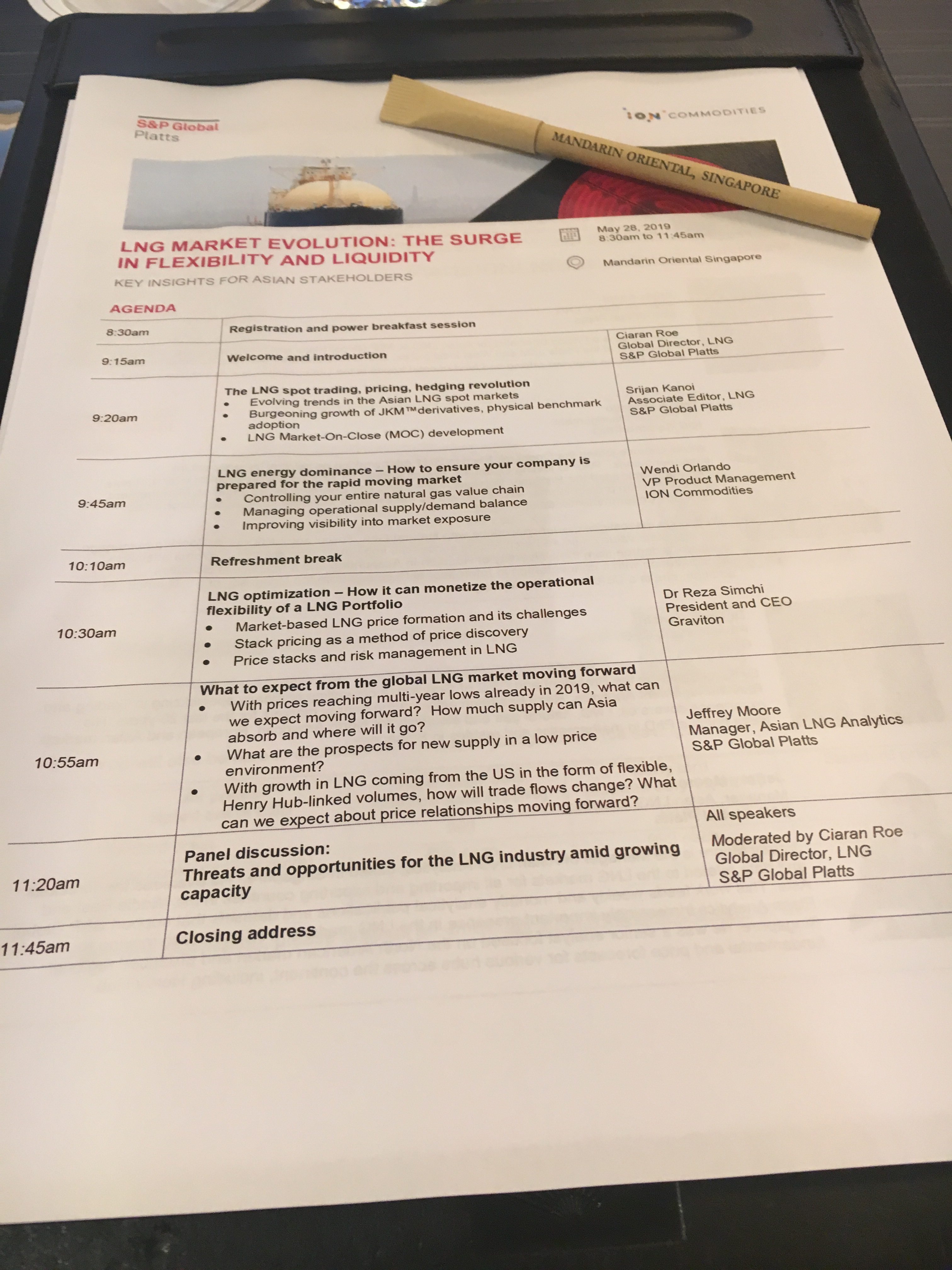

Powerful Breakfast Networking. S&P Platts: LNG MARKET EVOLUTION: THE SURGE IN FLEXIBILITY AND LIQUIDITY Hear first-hand from market specialists and analysts cover market updates, trends, provide an outlook and discuss risk management in the LNG market. #emtacintl #LNG

The LNG spot trading, pricing, hedging revolution

The LNG spot trading, pricing, hedging revolution

– Evolving trends in the Asia LNG spot markets

– Burgeoning growth of JKMTM derivatives, physical benchmark adoption

– LNG Market-ON-Close (MOC) development

LNG energy dominance – How to ensure company is prepared for the rapid moving market

– Controlling entire natural gas value chain

– Managing operational supply/demand balance

– Improving visibility into market exposure

LNG Optimization – How it can monetize the operational flexibility of a LNG Portfolio

– Market-based LNG price formation and its challenges

– Stack pricing as a method of price discovery

– Price stacks and risk management in LNG

What to expect from the global LNG market moving forward

What to expect from the global LNG market moving forward

– With prices reaching multi-year lows already in 2019, what can market expect moving forward? How much supply can Asia absorb and where will it go?

– What are the prospects for new supply in a low price environment?

– With growth in LNG coming from the US in the form of flexible, Henry Hub-linked volumes, how will trade flows change? what can market expect about price relationship moving forward?

Panel Discussion : Threats and opportunities for the LNG industry amid growing capacity.

Panel Discussion : Threats and opportunities for the LNG industry amid growing capacity.